Low cost automotive insurance coverage Beaumont TX is a perplexing puzzle for a lot of drivers. Navigating the intricate market requires a eager eye and a splash of willpower. The panorama of insurance coverage choices can appear overwhelming, however this information unveils the secrets and techniques to discovering reasonably priced protection with out sacrificing peace of thoughts.

From understanding the elements that affect premiums to evaluating insurance policies and suppliers, this complete exploration will equip you with the instruments to safe the absolute best deal. The challenges of discovering low-cost automotive insurance coverage in Beaumont, TX, are addressed head-on, offering a transparent path to reasonably priced safety.

Overview of Low cost Automobile Insurance coverage in Beaumont, TX

The automotive insurance coverage market in Beaumont, TX, like many different areas, is characterised by a spread of choices catering to numerous wants and budgets. Discovering reasonably priced protection whereas sustaining sufficient safety could be a problem, significantly given the particular elements affecting premiums on this area. This overview examines the market dynamics, widespread challenges, and key influencing elements.The Beaumont, TX, space presents distinctive challenges for drivers searching for reasonably priced insurance coverage.

Competitors amongst insurance coverage suppliers can differ, and the provision of specialised reductions could differ from different components of the state. Components like native driving habits, accident charges, and the prevalence of particular forms of automobiles can affect insurance coverage premiums.

Components Influencing Insurance coverage Premiums in Beaumont, TX

A number of elements contribute to the price of automotive insurance coverage in Beaumont. These elements can affect the pricing methods employed by numerous insurance coverage suppliers. Understanding these components is essential for drivers searching for reasonably priced protection.

- Driving Information: A driver’s historical past of accidents and violations instantly impacts insurance coverage premiums. A clear driving file, freed from main incidents, is commonly related to decrease premiums. Conversely, drivers with frequent accidents or site visitors violations face greater premiums.

- Automobile Sort and Worth: The kind of car insured considerably impacts premiums. Luxurious automobiles and high-performance vehicles usually have greater insurance coverage prices than normal fashions. The car’s worth additionally performs a job; higher-value automobiles often require extra substantial protection, leading to greater premiums.

- Protection Selections: The precise varieties and quantities of protection chosen instantly affect the premium. Complete and collision protection, together with legal responsibility limits, are essential elements in figuring out the general value of insurance coverage. Increased protection ranges translate to greater premiums.

- Geographic Location: Geographic location inside Beaumont and the encircling areas can have an effect on insurance coverage charges. Areas with greater accident charges or particular site visitors patterns may need barely greater premiums for drivers in these areas.

Widespread Insurance coverage Suppliers in Beaumont, TX

A number of insurance coverage suppliers cater to drivers searching for budget-friendly automotive insurance coverage in Beaumont. Selecting the best supplier typically entails evaluating insurance policies and contemplating numerous elements.

- State Farm: A well-established nationwide supplier, State Farm presents a variety of insurance coverage merchandise and continuously presents reductions for protected drivers and people with bundled providers.

- Geico: Recognized for its aggressive pricing, Geico typically targets drivers searching for decrease premiums, particularly with a deal with customer support and digital accessibility.

- Progressive: Progressive is one other well-liked nationwide supplier identified for its progressive strategy to insurance coverage and continuously presents reductions for individuals who preserve driving file.

- American Household Insurance coverage: This supplier typically caters to budget-conscious drivers with a deal with aggressive pricing and accessible customer support.

Kinds of Low cost Automobile Insurance coverage Choices

Price range-conscious drivers in Beaumont, TX, can discover reasonably priced automotive insurance coverage choices tailor-made to their particular wants and driving historical past. Understanding the various kinds of insurance policies out there is essential for making knowledgeable selections about protection and price. This part particulars numerous choices, evaluating protection and prices to assist drivers select the perfect match for his or her monetary scenario.

Legal responsibility-Solely Insurance policies

Legal responsibility-only insurance policies present the minimal protection required by legislation. They usually shield drivers if they’re discovered at fault in an accident, overlaying the opposite get together’s damages. Nonetheless, they don’t supply protection for the motive force’s personal car harm or accidents. That is typically essentially the most reasonably priced choice, making it enticing for drivers with restricted budgets. A standard instance of one of these protection is when a driver is concerned in a fender bender and their car sustained no harm.

Their coverage would cowl the opposite driver’s damages, however not their very own.

Complete Insurance policies

Complete insurance policies present broader protection than liability-only insurance policies. They shield drivers from damages to their car attributable to occasions similar to vandalism, fireplace, theft, or weather-related incidents, past collisions. Whereas complete protection usually prices greater than liability-only insurance policies, it presents peace of thoughts and monetary safety towards surprising occasions. For instance, a driver whose automotive was broken in a hailstorm can be lined by a complete coverage.

Collision Insurance policies

Collision insurance policies cowl damages to a driver’s car no matter who’s at fault in an accident. These insurance policies are designed to guard the motive force’s funding of their car in case of accidents. Collision protection typically comes with a deductible, that means the motive force pays a specific amount upfront earlier than the insurance coverage firm covers the remainder of the harm.

A collision coverage would shield the motive force if their automotive was broken in a collision with one other car, no matter fault.

Comparability of Protection and Value

| Coverage Sort | Protection Particulars | Estimated Value (Instance) |

|---|---|---|

| Legal responsibility-Solely | Covers damages to different events within the occasion of the motive force’s fault. Doesn’t cowl harm to the motive force’s car. | $200-$500 per 12 months |

| Complete | Covers damages to the motive force’s car attributable to occasions like vandalism, fireplace, theft, or weather-related incidents, past collisions. | $300-$800 per 12 months |

| Collision | Covers damages to the motive force’s car no matter fault in an accident. Features a deductible. | $250-$750 per 12 months |

Be aware: Estimated prices are examples and may differ considerably primarily based on elements similar to the motive force’s age, driving file, car sort, location, and the particular insurance coverage supplier.

Professionals and Cons of Every Coverage Sort

- Legal responsibility-Solely: Professionals: Low value. Cons: Restricted safety in case of harm to at least one’s personal car. It solely protects the motive force in case of accidents the place they’re at fault.

- Complete: Professionals: Protects towards a wider vary of damages. Cons: Usually dearer than liability-only insurance policies.

- Collision: Professionals: Protects towards harm to the motive force’s car no matter fault. Cons: Usually dearer than liability-only insurance policies and features a deductible.

Components Affecting Automobile Insurance coverage Prices in Beaumont

Automobile insurance coverage premiums in Beaumont, TX, like elsewhere, are influenced by quite a lot of elements past merely the protection chosen. Understanding these elements can assist people make knowledgeable selections about their insurance coverage decisions and doubtlessly discover extra reasonably priced choices.Insurance coverage corporations assess threat to find out acceptable premiums. The next perceived threat interprets to a better premium. Components similar to driving historical past, car traits, and site throughout the metropolis all contribute to this threat evaluation.

These elements are meticulously thought-about by insurance coverage suppliers to precisely mirror the potential legal responsibility publicity.

Driving Report Influence on Premiums

Driving information are a crucial element in figuring out automotive insurance coverage premiums. A clear driving file, characterised by a scarcity of accidents and site visitors violations, usually leads to decrease premiums. Conversely, a historical past of accidents or violations, significantly these involving vital harm or severe offenses, instantly will increase premiums. This displays the upper chance of future claims for these with a historical past of incidents.

Insurance coverage corporations use detailed driving information to evaluate particular person threat.

Automobile Sort and Age Influence on Premiums

Automobile sort and age considerably affect automotive insurance coverage premiums. Increased-performance automobiles, similar to sports activities vehicles or luxurious fashions, are inclined to have greater premiums attributable to their elevated potential for harm and theft. Older automobiles, significantly these with out trendy security options, typically have greater premiums attributable to a larger chance of mechanical failures or accidents. This can be a direct reflection of the car’s susceptibility to wreck and restore prices.

Location Inside Beaumont Influence on Premiums

Geographic location inside Beaumont can even influence insurance coverage premiums. Areas with greater charges of accidents or theft may need greater premiums. Proximity to particular areas with identified site visitors congestion, high-risk driving behaviors, or high-theft areas can all play a job in pricing. The insurance coverage supplier’s evaluation of native incident reviews is vital to this willpower.

Relationship Between Components and Premium Prices

| Issue | Description | Influence on Premium Value | Instance |

|---|---|---|---|

| Driving Report | Accidents, violations, and claims historical past | Clear file = decrease premium; Accidents = greater premium | A driver with a number of rushing tickets will doubtless pay a better premium than a driver with a clear file. |

| Automobile Sort | Sports activities automotive, luxurious car, basic automotive | Increased-performance or distinctive automobiles = greater premium | A high-performance sports activities automotive is more likely to have a better premium than a regular sedan. |

| Automobile Age | 12 months of manufacture | Older automobiles = doubtlessly greater premium | A ten-year-old car with out superior security options may need a better premium than a more recent mannequin with such options. |

| Location | Particular neighborhood or space inside Beaumont | Areas with excessive accident charges = greater premium | A neighborhood identified for high-speed driving may need greater premiums in comparison with a extra residential space. |

Methods for Discovering Low cost Automobile Insurance coverage in Beaumont

Securing reasonably priced automotive insurance coverage in Beaumont, TX, requires a proactive strategy. Understanding the assorted methods for evaluating quotes, negotiating premiums, and leveraging reductions can considerably influence the price of your protection. This part Artikels key methods for reaching cost-effective automotive insurance coverage within the area.

Evaluating Quotes from A number of Suppliers

Acquiring aggressive quotes from numerous insurance coverage suppliers is essential for locating reasonably priced automotive insurance coverage. Evaluating quotes permits for a complete evaluation of assorted protection choices and premiums. This proactive strategy ensures policyholders are receiving the absolute best worth for his or her premiums.

- Make the most of on-line comparability instruments: Quite a few web sites facilitate the comparability of automotive insurance coverage quotes from a number of suppliers. These instruments usually require fundamental details about the car, driver, and desired protection to generate quotes from a number of insurance coverage corporations. Inputting this information will rapidly furnish a variety of quotes for comparability. This technique gives a streamlined strategy to figuring out aggressive charges.

- Request quotes instantly from insurance coverage corporations: Straight contacting insurance coverage suppliers by way of telephone or their web sites is one other strategy to acquiring quotes. Whereas this will likely contain extra particular person effort, it presents the chance to debate particular wants and preferences with an agent. The interplay permits for personalised recommendation, potential reductions, and tailoring of protection to fulfill particular necessities.

- Think about native insurance coverage businesses: Native businesses can supply insights into regional insurance coverage market developments. They’ll present tailor-made suggestions primarily based on driver historical past and car specifics, providing the chance for a customized quote expertise.

Negotiating Decrease Premiums with Suppliers

Negotiation is a viable technique for acquiring extra favorable automotive insurance coverage premiums. Demonstrating a dedication to sustaining a protected driving file and a accountable insurance coverage historical past is commonly key.

- Assessment your present coverage: Understanding the main points of your present coverage, together with protection ranges and any present reductions, is step one. Figuring out areas the place you might be able to cut back protection or modify the coverage construction can result in potential financial savings.

- Discover various protection choices: Think about in case your present protection ranges are sufficient on your wants. Adjusting protection, for instance, to scale back collision protection if the car is older or is roofed by different insurance coverage can yield potential financial savings. Changes ought to align with the motive force’s wants and monetary capability.

- Focus on potential reductions: Many insurance coverage corporations supply numerous reductions for particular elements similar to protected driving information, defensive driving programs, anti-theft units, and a number of automobiles insured underneath the identical coverage. Insurance coverage brokers can present particular data on these reductions and the way they’ll cut back premiums.

The Position of Reductions in Attaining Inexpensive Insurance coverage

Reductions are sometimes a vital part in acquiring reasonably priced insurance coverage premiums. Maximizing the potential for reductions is an efficient technique.

- Secure driving information: Insurance coverage corporations typically reward drivers with clear information with decrease premiums. Sustaining a protected driving historical past and avoiding accidents is crucial for minimizing insurance coverage prices.

- Defensive driving programs: Finishing defensive driving programs demonstrates a dedication to protected driving practices. Many insurance coverage corporations supply reductions for collaborating in these programs.

- Bundled insurance policies: Insuring a number of automobiles or different forms of insurance coverage (e.g., dwelling) with the identical supplier could end in bundled reductions.

- Anti-theft units: Putting in anti-theft units on a car can typically qualify for reductions.

- Good scholar reductions: College students with good tutorial standing typically qualify for reductions.

Step-by-Step Information to Discovering Low cost Insurance coverage in Beaumont

A scientific strategy can assist navigate the method of discovering reasonably priced automotive insurance coverage.

- Collect needed data: Compile all related details about the car, driver, and desired protection ranges. This contains car identification numbers, driving historical past, and desired protection quantities.

- Use on-line comparability instruments: Make the most of on-line instruments to acquire quotes from a number of suppliers, evaluating protection particulars and premiums. Examine quotes throughout totally different suppliers for a complete evaluation.

- Contact insurance coverage suppliers instantly: Contacting insurance coverage brokers instantly permits for personalised suggestions and a deeper understanding of particular wants and protection choices.

- Negotiate for decrease premiums: Focus on potential reductions and discover various protection choices to scale back premiums. Assessment coverage phrases and circumstances completely.

- Select essentially the most appropriate coverage: Fastidiously consider the assorted choices, contemplating elements similar to protection ranges, premiums, and reductions, to pick essentially the most appropriate coverage on your wants.

Insurance coverage Supplier Comparisons in Beaumont

Comparative evaluation of insurance coverage suppliers in Beaumont, Texas, is essential for budget-conscious drivers searching for essentially the most aggressive charges and dependable service. Understanding the strengths and weaknesses of various suppliers permits knowledgeable selections relating to insurance coverage choice. This evaluation considers elements like pricing, protection choices, and customer support scores to facilitate an knowledgeable alternative.Comparative evaluation of insurance coverage suppliers is important for budget-conscious drivers to establish essentially the most aggressive charges and dependable providers.

It permits for knowledgeable selections relating to insurance coverage choice, enabling drivers to decide on suppliers that finest meet their particular wants and monetary constraints. Completely different suppliers supply various protection choices and customer support requirements, and this comparability goals to make clear these variations.

Main Insurance coverage Suppliers in Beaumont

A number of main insurance coverage suppliers function in Beaumont, every with its personal pricing methods and repair choices. Understanding the strengths and weaknesses of those suppliers helps shoppers discover the most suitable choice. These suppliers typically supply totally different tiers of protection, which influence premium prices.

Aggressive Charges for Price range-Aware Drivers

A number of suppliers persistently rank excessive in providing aggressive charges for budget-conscious drivers in Beaumont. These suppliers usually prioritize worth and effectivity of their operations, providing cost-effective insurance policies with out compromising important protection. Examples of those suppliers could embrace smaller, regional insurers that concentrate on particular demographic teams or specialised protection.

Supplier Status and Buyer Service Scores

Supplier fame and customer support scores considerably affect the selection of insurance coverage. Drivers searching for dependable service typically prioritize suppliers with optimistic suggestions relating to declare processing, coverage changes, and general communication. Dependable customer support can considerably influence the motive force expertise. Adverse opinions, nonetheless, could recommend potential points in service high quality, doubtlessly growing the chance of issues throughout coverage administration.

Comparability Desk

| Insurance coverage Supplier | Protection Choices (Instance) | Estimated Month-to-month Premium (Instance) | Buyer Service Score (Instance) |

|---|---|---|---|

| State Farm | Complete, Collision, Legal responsibility | $150-$250 | 4.5/5 stars (primarily based on buyer opinions) |

| Geico | Legal responsibility, Uninsured Motorist, Private Damage Safety | $120-$200 | 4.0/5 stars (primarily based on buyer opinions) |

| Progressive | Collision, Complete, Roadside Help | $135-$220 | 4.2/5 stars (primarily based on buyer opinions) |

| Allstate | Legal responsibility, Medical Funds, Uninsured Motorist | $140-$260 | 3.8/5 stars (primarily based on buyer opinions) |

| American Household | Collision, Complete, Private Damage Safety | $110-$190 | 4.3/5 stars (primarily based on buyer opinions) |

Be aware: Premiums are estimates and may differ primarily based on particular person driver profiles and protection picks. Customer support scores are primarily based on publicly out there information and should not characterize each buyer’s expertise.

Ideas for Sustaining Inexpensive Automobile Insurance coverage

Sustaining reasonably priced automotive insurance coverage requires proactive measures past merely selecting a supplier. Constant accountable driving and sensible car decisions contribute considerably to decrease premiums. Understanding and using out there reductions can even make a considerable distinction within the general value. These methods, when applied persistently, create a virtuous cycle of accountable driving and monetary financial savings.

Sustaining a Optimistic Driving Report

A clear driving file is paramount in securing favorable insurance coverage charges. Constant adherence to site visitors legal guidelines and protected driving practices is essential. Accidents, even minor ones, can negatively influence future premiums. Recurrently reviewing driving habits and actively searching for methods to enhance security, similar to defensive driving programs, can contribute to a optimistic driving file and consequently, decrease insurance coverage premiums.

- Avoiding rushing tickets and site visitors violations considerably reduces the chance of elevating insurance coverage premiums.

- Taking part in defensive driving programs can improve driving abilities and data, resulting in fewer accidents and sustaining a protected driving file.

- Promptly reporting any accidents or incidents, even minor ones, is important for sustaining a transparent file and avoiding potential future penalties.

Deciding on a Automobile with a Decrease Insurance coverage Classification

Automobile make, mannequin, and options affect insurance coverage prices. Sure automobiles are inherently dearer to insure attributable to elements like greater restore prices, theft threat, or potential for harm. Understanding these elements can assist in selecting a car that aligns with affordability and security issues.

- Autos with superior security options, similar to airbags and anti-lock brakes, typically have decrease insurance coverage classifications attributable to diminished threat of harm or harm.

- Deciding on a cheaper car mannequin can contribute to a decrease insurance coverage classification and thus, a extra reasonably priced premium.

- Autos with a better chance of theft or harm could carry a better insurance coverage classification, growing premiums.

Proactively Managing Danger to Preserve Low Premiums

Taking proactive steps to scale back the chance of accidents can instantly translate to decrease insurance coverage premiums. These actions deal with controlling elements inside one’s management to forestall accidents.

- Sustaining a well-maintained car, together with correct tire strain and common upkeep, reduces the chance of mechanical failures and accidents.

- Practising protected parking habits, together with parking in well-lit and safe areas, can cut back the chance of car theft or harm.

- Understanding and adhering to native site visitors legal guidelines and laws is essential for sustaining a optimistic driving file and minimizing the chance of accidents.

Understanding and Using Insurance coverage Reductions

Insurance coverage suppliers supply numerous reductions that may considerably cut back premiums. Recognizing these alternatives and leveraging them can considerably decrease the general value of automotive insurance coverage.

- Reductions for protected driving packages and accident-free driving information are widespread and infrequently available to eligible drivers.

- Bundling a number of insurance coverage merchandise, similar to dwelling and auto insurance coverage, with the identical supplier, typically results in reductions.

- Anti-theft units and safety techniques put in on automobiles can even result in discounted premiums.

- Reductions for college students and senior residents, when relevant, are available for eligible drivers.

Further Issues for Beaumont Drivers

Beaumont, Texas, presents distinctive circumstances that drivers ought to contemplate when evaluating and securing automotive insurance coverage. These elements, starting from native site visitors patterns to potential monetary dangers, can considerably influence premium prices and the general insurance coverage expertise. Understanding these nuances is essential for making knowledgeable selections about insurance coverage protection.Native elements in Beaumont, similar to higher-than-average charges of accidents or particular forms of car theft, can affect insurance coverage premiums.

Moreover, native laws and legal guidelines pertaining to driving practices and insurance coverage necessities can influence coverage prices and procedures. Lastly, Beaumont drivers want to pay attention to widespread insurance coverage scams to guard themselves from monetary exploitation.

Distinctive Native Components Impacting Insurance coverage Premiums

Beaumont’s location and demographics contribute to particular elements that have an effect on insurance coverage prices. Increased charges of sure forms of accidents, like these involving uninsured or underinsured motorists, can result in greater premiums for drivers within the space. Moreover, native financial circumstances and employment charges can affect the frequency and severity of claims, which might be mirrored in insurance coverage premiums.

Particular Rules and Legal guidelines Related to Automobile Insurance coverage

Texas state legal guidelines dictate the minimal necessities for automotive insurance coverage. These legal guidelines could differ in utility primarily based on particular native ordinances or enforcement practices. Understanding these laws is significant to make sure compliance and keep away from potential penalties. Policyholders ought to seek the advice of with insurance coverage brokers to make sure they’re adhering to all related native and state laws.

Abstract of Monetary Facets of Insuring a Automobile

The monetary burden of insuring a car in Beaumont, like in any location, contains the premium prices, deductibles, and potential declare payouts. Understanding these features is important for budgeting and managing the monetary dangers related to automotive possession. Policyholders ought to evaluate totally different protection choices to search out essentially the most cost-effective strategy to insurance coverage. An in depth evaluation of particular person monetary circumstances and insurance coverage wants is really helpful to optimize the cost-benefit ratio of insurance coverage protection.

Widespread Insurance coverage Scams Focusing on Drivers

Drivers in Beaumont, like elsewhere, want to pay attention to widespread insurance coverage scams. These embrace fraudulent claims, misleading brokers, and makes an attempt to use policyholders. Scammers typically use false guarantees of decrease premiums or exaggerated claims of protection to lure unsuspecting drivers. Consciousness and vigilance are essential in avoiding these scams and defending private funds. Drivers ought to confirm the legitimacy of any insurance coverage supply or declare.

Illustrative Examples of Insurance coverage Quotes

Illustrative examples of insurance coverage quotes for numerous automobiles and drivers in Beaumont, TX present a sensible understanding of the elements influencing premiums. These examples display the potential value variations throughout totally different insurance coverage suppliers and spotlight the influence of particular person circumstances. Analyzing these quotes permits shoppers to match choices successfully and make knowledgeable selections relating to their insurance coverage protection.

Automobile-Particular Quote Variations

Understanding the influence of car sort on insurance coverage premiums is essential. The next-value, newer car, significantly one with superior security options, will typically command a decrease premium in comparison with a much less fascinating car. This displays the diminished threat related to the newer mannequin, typically geared up with applied sciences that mitigate the chance of accidents or harm. Conversely, older fashions or automobiles with a historical past of accidents could appeal to greater premiums as a result of elevated threat of claims.

Driver-Particular Quote Variations, Low cost automotive insurance coverage beaumont tx

Driver traits considerably affect insurance coverage premiums. Components similar to age, driving file, and site of residence all contribute to the calculation. Youthful drivers typically face greater premiums attributable to their statistically greater accident charges in comparison with extra skilled drivers. Likewise, drivers with a historical past of accidents or site visitors violations will doubtless encounter greater premiums reflecting their elevated threat profile.

Areas with greater accident charges or greater frequency of theft could end in greater premiums for drivers in these areas.

Illustrative Quote Desk

The next desk presents hypothetical insurance coverage quotes for numerous car and driver profiles in Beaumont, TX. It illustrates the variance in premiums throughout totally different insurance coverage suppliers, contemplating the particular protection particulars and coverage provisions. Be aware that these are illustrative examples and precise quotes could differ.

| Automobile | Driver Profile | Insurance coverage Supplier A | Insurance coverage Supplier B | Insurance coverage Supplier C |

|---|---|---|---|---|

| 2020 Honda Civic | 25-year-old, clear driving file, lives in Beaumont | $1200/12 months | $1350/12 months | $1150/12 months |

| 2015 Ford F-150 | 45-year-old, clear driving file, lives in Beaumont | $1800/12 months | $1700/12 months | $1650/12 months |

| 2010 Toyota Camry | 30-year-old, 2 minor site visitors violations, lives in Beaumont | $1500/12 months | $1600/12 months | $1450/12 months |

Components Contributing to Premium Variations

The variations in quotes mirror the totally different threat assessments employed by every insurance coverage supplier. Components thought-about embrace car make, mannequin, and 12 months, driver age, driving historical past, location of residence, and chosen protection choices. Insurance coverage suppliers weigh these elements to estimate the chance of future claims and, consequently, the related monetary threat. Coverage provisions, similar to deductibles, additionally have an effect on the ultimate premium.

Visible Illustration of Premium Variations

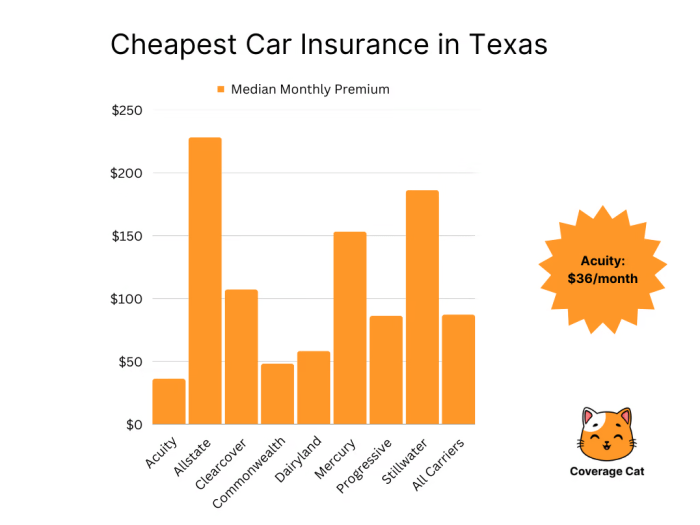

(Be aware: A visible illustration, similar to a bar chart, may very well be included right here. The chart would show the premiums for every supplier and car/driver profile. The chart would clearly illustrate the variations in pricing between suppliers.)

Conclusive Ideas: Low cost Automobile Insurance coverage Beaumont Tx

In conclusion, securing low-cost automotive insurance coverage in Beaumont, TX, is achievable with the fitting data and strategy. By understanding the market, evaluating choices, and using out there methods, drivers can confidently navigate the complexities and discover reasonably priced protection tailor-made to their particular wants. Armed with the insights offered right here, you might be well-positioned to search out the proper match on your funds and peace of thoughts.

Query Financial institution

What are the most typical insurance coverage scams concentrating on Beaumont drivers?

Be cautious of unsolicited calls or emails promising exceptionally low charges. At all times confirm the legitimacy of insurance coverage suppliers by official channels and keep away from sharing private data with unknown events. Real insurance coverage corporations won’t ever ask for delicate data by way of unsolicited messages.

How can I preserve a optimistic driving file to maintain my insurance coverage premiums low?

Adhering to site visitors legal guidelines, avoiding accidents, and sustaining a protected driving type are key to sustaining a clear driving file. Recurrently checking your driving file for any errors or omissions is essential.

What are the everyday reductions out there for automotive insurance coverage in Beaumont?

Reductions for protected drivers, anti-theft units, and a number of automobiles are widespread. Some corporations could supply reductions for being a scholar or having tutorial file. Analysis numerous reductions supplied by totally different suppliers within the space.

What are the everyday elements that have an effect on automotive insurance coverage premiums in Beaumont, TX?

Driving file, car sort and age, and site inside Beaumont are key elements. A historical past of accidents or site visitors violations will improve premiums, whereas newer, safer automobiles typically include decrease charges. Particular neighborhoods in Beaumont might also affect premiums attributable to native elements like crime charges.